安森美半導體公司 (ON Semiconductor Corporation,美國納斯達克上市代號:ON)于美國時間8月2日公布2021年第2季度業績,摘要如下:

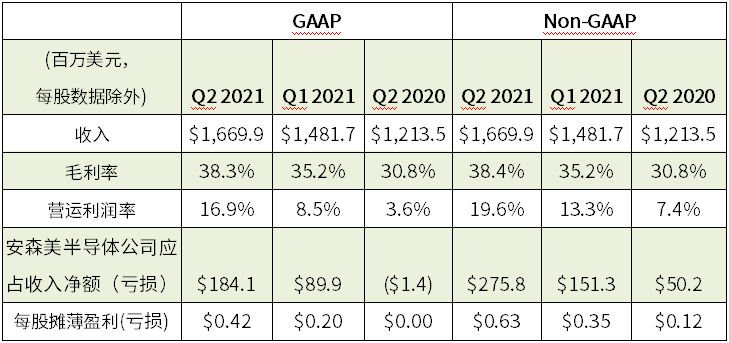

創紀錄的16.699億美元收入,同比增長38%

公認會計原則(GAAP)每股攤薄盈利為$0.42美元,去年同比為$0.00美元

創紀錄的非公認會計原則(Non-GAAP)每股攤薄盈利為$0.63美元,去年同比為$0.12美元

GAAP毛利率為38.3%,環比增長310個基點,去年同比增長750個基點

Non-GAAP毛利率為38.4%,環比增長320個基點,去年同比增長760個基點

創紀錄的可用流動現金為3.832億美元,或總收入的22.9%

安森美半導體總裁兼首席執行官(CEO) Hassane El-Khoury說:

“我們強勁的第2季度業績是由堅實的執行力和持續的結構改革以及強勁的需求環境所推動的。我們又一次公布季度non-GAAP毛利率擴張,利潤率環比增長增加了320個基點。我們預期持續的業務結構改革應使我們能夠在可持續的基礎上表現強勁的業績。雖然我們為最近的業績感到鼓舞,但我們仍將繼續變革業務以充分發揮公司潛力。

我們繼續看到我們的戰略汽車和工業終端市場對我們產品的需求在加速增長。隨著我們繼續推動我們生產據點的運營效率,我們預計在2021年下半年將看到增量供應和收入增長。”

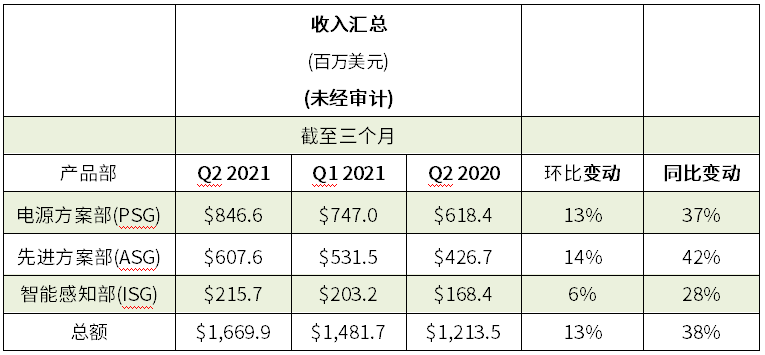

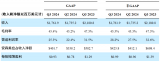

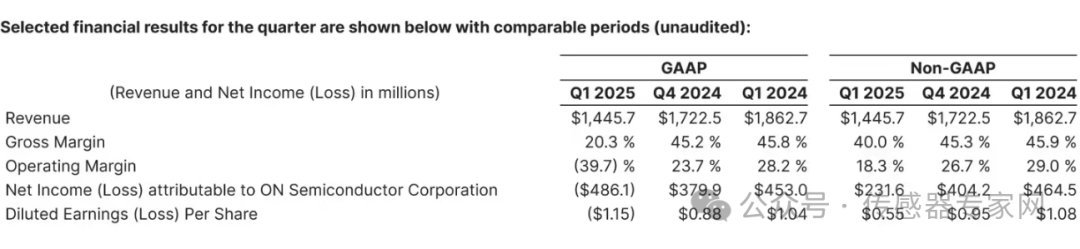

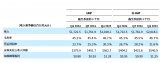

下表概列本季度與可比較時期的部分財務業績:

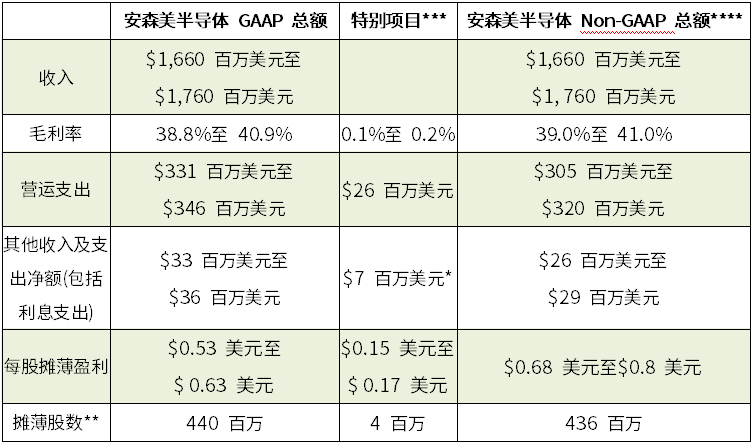

2021年第3季度展望

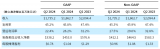

下表概列安森美半導體預期的2021年第3季度的GAAP及Non-GAAP展望:

*

Convertible Notes, Non-cash interest expense is calculated pursuant to FASB‘s Accounting Standards Codification Topic 470: Debt.

**

Diluted shares outstanding can vary as a result of, among other things, the actual exercise of options or vesting of restricted stock units, the incremental dilutive shares from the Company’s convertible senior subordinated notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods when the quarterly average stock price per share exceeds $20.72, the non-GAAP diluted share count and non-GAAP net income per share include the anti-dilutive impact of the Company’s hedge transactions issued concurrently with the 1.625% convertible notes. At an average stock price per share between $20.72 and $30.70, the hedging activity offsets the potentially dilutive effect of the 1.625% convertible notes. In periods when the quarterly average stock price exceeds $30.70 for the 1.625% Notes, the dilutive impact of the warrants issued concurrently with such notes is included in the diluted shares outstanding. Both GAAP and non-GAAP diluted share counts are based on the Company’s stock price as of April 2, 2021.

***

Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; purchased in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; non-cash interest expense; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably estimate and separately present the individual impact or probable significance of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward-looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

****

We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies‘ non-GAAP financial measures, even if they have similar names.

編輯:jq

-

工業

+關注

關注

3文章

2031瀏覽量

47774 -

安森美半導體

+關注

關注

17文章

565瀏覽量

61628 -

GAAP

+關注

關注

0文章

29瀏覽量

6573

原文標題:我司報告2021年第2季度收入及Non-GAAP每股盈利創紀錄

文章出處:【微信號:NVIDIA_China,微信公眾號:NVIDIA英偉達】歡迎添加關注!文章轉載請注明出處。

發布評論請先 登錄

安森美2025年第一季度業績 收入14.457億美元 自由現金流持續增長

使用安森美WebDesigner+設計工具的120W DC-DC隔離電源設計

從60%暴跌到33%,全球汽車CIS傳感器絕對王者,被國產巨頭干翻

安森美2024年Q4及全年業績亮眼

安森美榮獲2024亞洲金選雙料大獎

細數安森美重磅功率器件產品

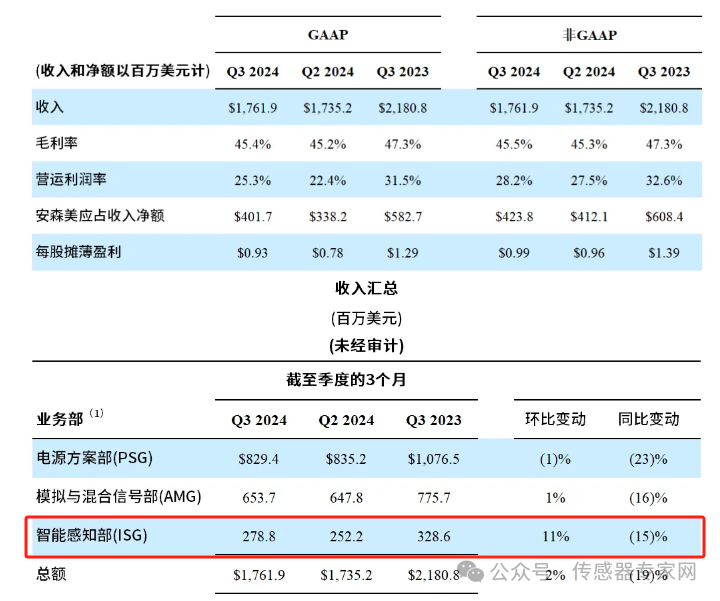

安森美公布 2024 年第三季度業績

安森美第三季度收入17.619億美元

安森美公布2024年第二季度業績

安森美發布2021年第2季度業績報告

安森美發布2021年第2季度業績報告

評論